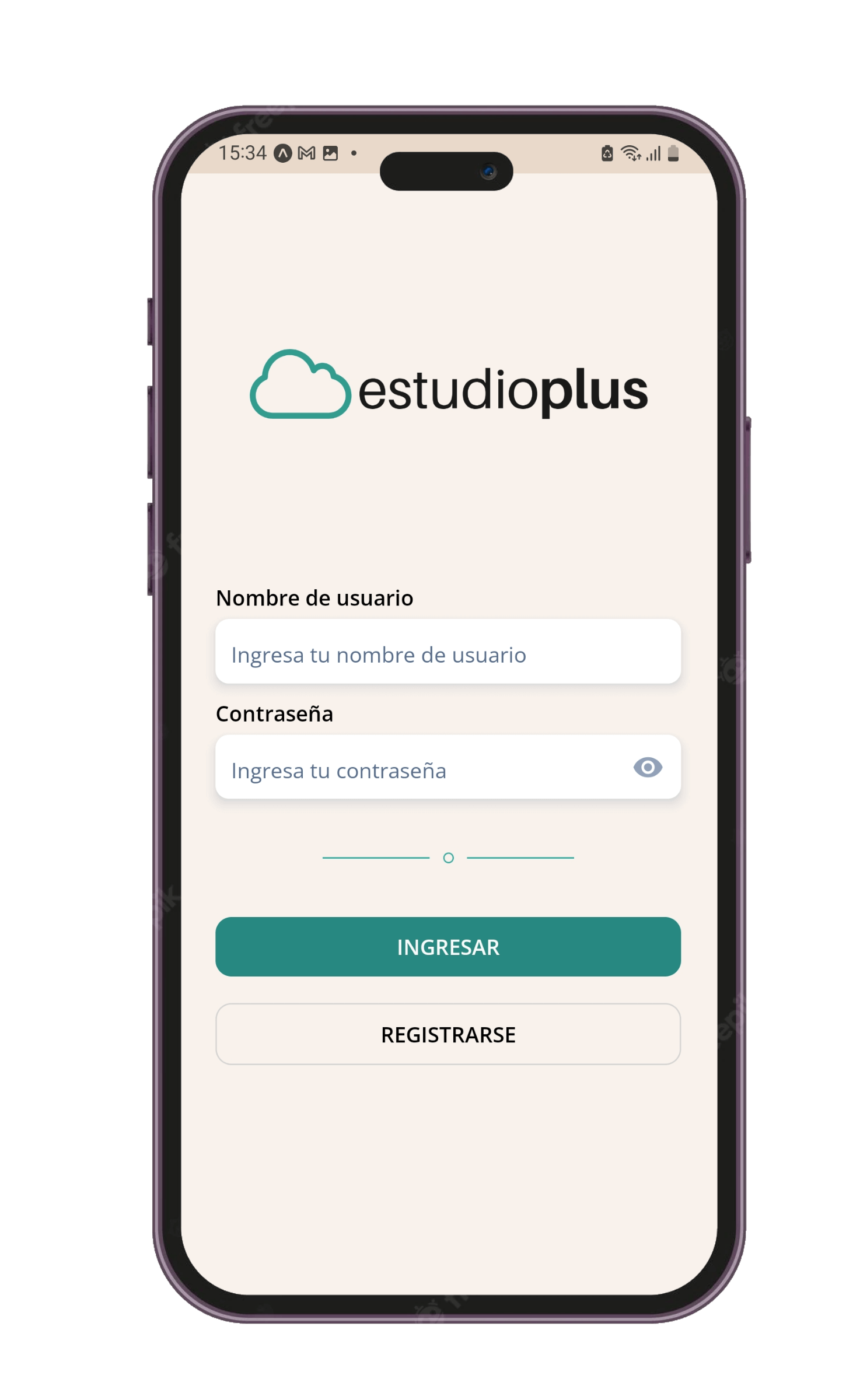

WE ARE ESTUDIO PLUS

ABOUT US

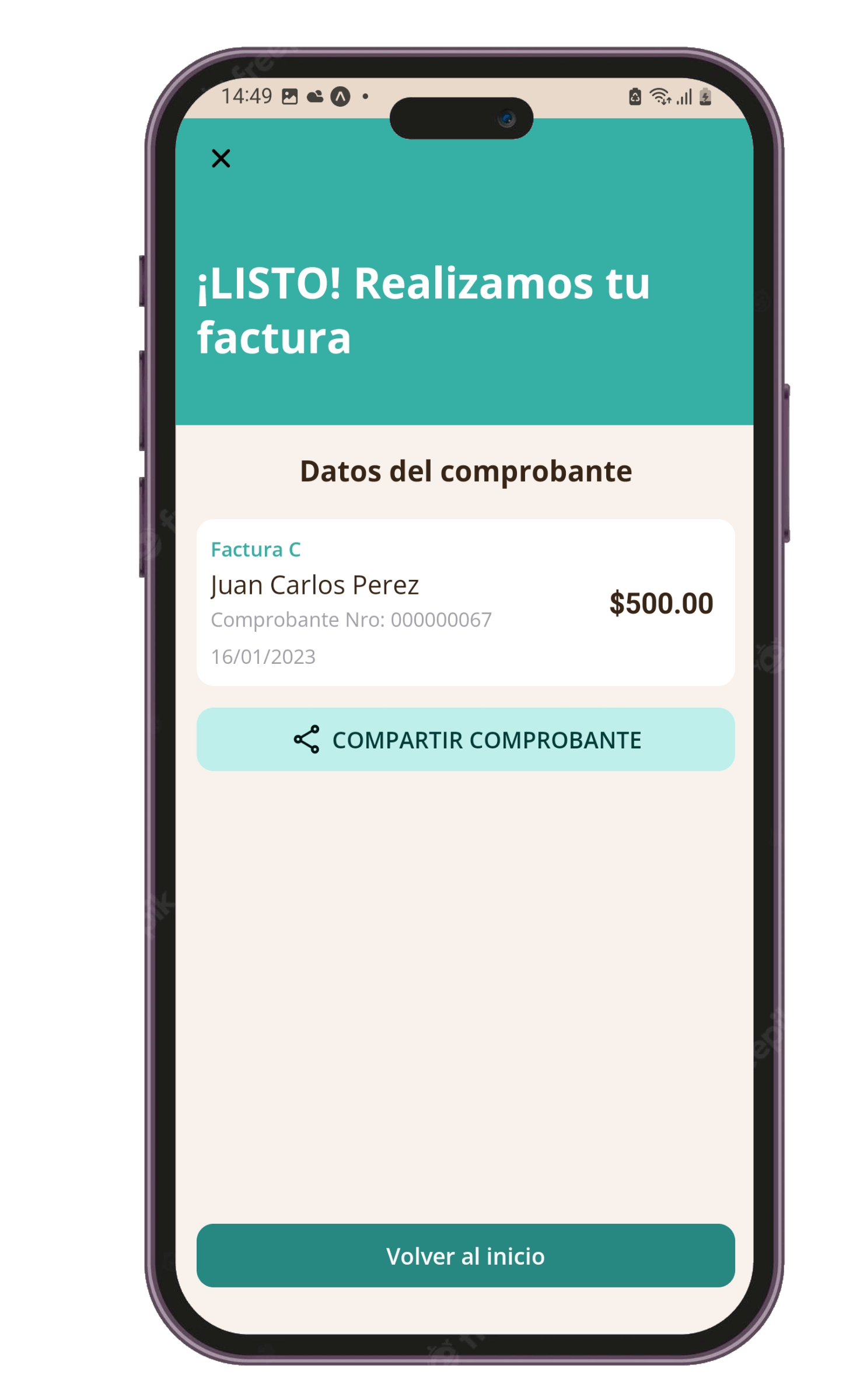

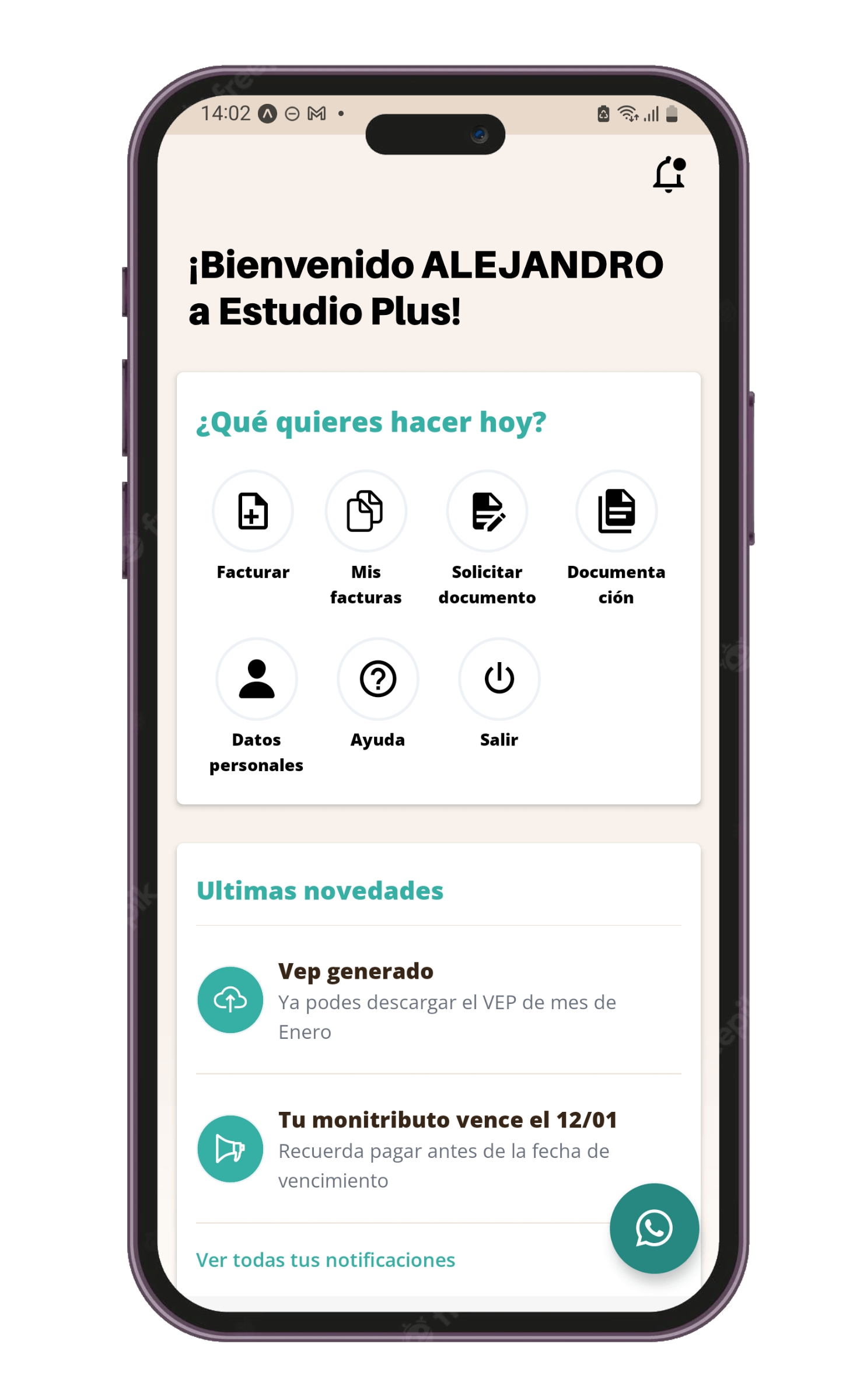

Estudio Plus es la plataforma ideal para los monotributistas.

Su día a día hace que la gestión habitual sea compleja y desorganizada. Nosotros acompañamos ese proceso para que puedan comenzar a trabajar inmediatamente en cualquier plataforma de forma accesible, ágil y simple.

DOUBTS?

FAQS

With Estudio Plus you can enroll in monotributo. for that complete

the following form. GO TO FORM

In less than 48 hours you will be registered to start working.

From your cell phone, it's easier and faster.

Download the "MI AFIP" app and request your tax code!

Presencial

To obtain the fiscal key it is necessary to previously request a shift

web. SOLICITA UN TURNO EN ARCA.

Native or naturalized Argentines: original and photocopy of the digital ID.

Foreigners: original and photocopy of the identity document of the country of

origin, passport or MERCOSUR ID (if it is from a country

bordering).

Foreigners residing in the country (including temporary or

transitory) who do not have a national identity document: original and

photocopy of the identity card, certificate or proof that

accredit the file number assigned by the National Directorate of

Migrations, where the nature of your residence is stated.

Consult the current amounts and categories. CLICK HERE.

Si. Si ya estás pagándola detallá cómo, y si no elegí pagarla junto con el

monotributo.

- Pay retirement with monotributo

Si no trabajás en relación de dependencia o no estás pagando tu

jubilación de ninguna forma, tenés que incluirlo en la cuota de

monotributo. - I am employed dependency relationship

Tenés que indicar el CUIT de tu empleador y la fecha de inicio de cuando

empezaste a trabajar.

Si elegís esto no podés elegir obra social porque también te la tiene que

proveer tu empleador. - I am retired

– Si estás jubilado por la ley actual (Nº 24.241) tenés que

pagar aportes jubilatorios. Para jubilados a partir del

07/1994.

– Si estás jubilado por leyes anteriores (Nº 18.037 y Nº

18.038) no tenés que pagar aportes. Para jubilados hasta

el 06/1994.

– En ambos casos no pagás obra social dado que ya estás

afiliado a PAMI. - Contribution to provincial pension funds

- Pay retirement with monotributo

In this case you do not have to pay retirement contributions or social work.

As a monotributista you have the right and obligation to choose and pay

your social work. Whether you can do it or not depends on what you have

indicated in the previous step (retirement contributions).

Unify contributions with spouse

Optionally you can unify social work contributions with your spouse,

as long as they have the same social work. You need the CUIT of the

person to search for.

Add family

Optionally, you can cover family members with your social work, paying a

extra for each. You need the CUIL of the relative and indicate your

relation.

Those monotributistas framed in categories A, B, C, D, E, F,

G and H will be able to access the following family allowances:

- Family Allowance for Prenatal

- Family Allowance for Child / Child with Disability

- Family Allowance for Annual School Aid

While the monotributistas with category I, J and K, will be able to access

to:

- Family Allowance for Child / Child with Disability

- Family Allowance for Annual School Aid per child with

Disability

The amount to be received will depend on the category to which each holder is

contributing.

Check the requirements in ANSES

- Homebanking Link: In order to use this service, previously

you must go with your debit card to ATMs

that are from the same network as said card, to obtain the

access token. - Red Banelco: To use this service, you must select the

option other operations, to obtain the password.

Then you can make payments by entering the page

http://www.pagomiscuentas.com - MercadoPago: From any electronic device that

have the Mercado Pago application or from the website of

Mercado Pago. - Provincia NET: through this platform,

You will be able to pay any type of tax that you paid in a

on-site collection post.

First you must register, creating a username and password.

Once logged in you will have the option to perform Payments with

bill (in case of having a barcode) or Payments without

bills. In this last option you must detail the service that

you want to pay, indicating the requested data. It is important

Note that payments will be made by credit card.

debit from any bank. - Automatic debit in bank account: To request the

accession of the automatic debit in your bank account in pesos. - Credit cards: You can make the telephone payment or adhere to the automatic debit using the numbers that we provide below:

Argencard – Mastercard – (011) 4340-5665

Cabal – (011) 4319-2550

Visa – (011) 4378-4499

Also, if you use a VISA card, you can pay or adhere to the debit

automatic on the website http://www.visa.com.ar/

You also have the possibility of making the payment by Mastercard in

www.masterconsultas.com.

It is the evaluation of parameters that must be carried out by the

monotributistas to know if they should maintain the category in which they are

find or must modify it. If these parameters exceed or are

lower than those of the current category, it is necessary to carry out the

recategorization.

No action shall be taken by those who maintain the same

category.

The recategorization periods are every 6 months, in January and July, and

when they arrive, the activity of the last 12 months must be evaluated; if

there were changes in income, rents and others, you have to enter with

password to recategorize; if it is not done, it is understood that there was no

changes and remains in the same category.

What parameters should be taken into account?

The following must be considered in relation to the last 12 months:

- cumulative gross income

- electrical energy consumed

- accrued rents and/or area affected by the activity

You can unsubscribe from the monotribute at any time. The month in

that you request the withdrawal you have to pay the period normally. Starting

of the following month, the cancellation becomes effective and the

monotribute. Keep in mind that if you were making contributions from

retirement and social work with monotributo, you will stop doing it.

What situations cause me to be excluded from the monotax?

There are situations that generate the cancellation of the monotax. This happens

when:

The sum of your gross income exceeds the maximum established by the

maximum available category.

The square footage or rental cost exceeds the maximum established by

the maximum available category .

You exceed the maximum unit sale price.

You acquire goods or make personal expenses for a value greater than the

gross income admitted by the maximum category available.

Your bank deposits are greater than the income Gross admitted

for the maximum category available.

You have imported goods or services during the

last 12 months.

You carry out more than 3 simultaneous activities or have more than 3 exploitation units

(local).

You provide services and you categorized yourself as if you

sale products.

You would have carried out operations without having invoiced.

The value of purchases plus the expenses of the development of the activity

during the last 12 months is equal to or more than 80%, in the case of

sale of products, or more than 40% in the case of provision of

services, of the maximum gross income established for the maximum

category available for each case.

You are included in the public registry of employers with labor sanctions

(REPSAL).

Exclusion by operation of law due to systemic controls

It occurs when we verify the existence of any of the causes

for exclusion and, as a consequence, your registration in the monotributo

is canceled to register you in the general regime.

The exclusion will be notified at your Electronic Fiscal Address and to through

the portal. In addition, by entering the service "Monotributo - Exclusion by

full right" you can find out the reasons for your exclusion.

The list of excluded is published on the first business day of each month and

you can consult it by accessing the portal with your tax code.

In case of disagreement, you can appeal the decision within 15

days after the notification by entering the service with tax code

“Monotributo – Full Exclusion”, option “Presentation of

appeal Art. 74 Decree No. 1,397/79”.

To check the status of the process, enter the service “Monotributo –

Exclusion of full rights”, option “Check appeal status Art.

74 Decree No. 1,397/79” and withdraw the appeal from the option “Desist

from the appeal Art. 74 Decree No. 1,397/79”.

Exclusion by full right due to face-to-face inspection

If after the controls carried out in an audit the presence of any cause of excl is detected full use of the regime,

the official will notify you of this circumstance and will make the evidence

at your disposal. At that time, or within 10 days thereafter,

you can formally file your release.

PLANS

BLOG

¿Qué pasa si no hice la recategorización?

Montos y categorías vigentes

Recategorización 2026

Nuevo convenio Sancor Salud + Estudio Plus

Escalas, topes e importes – Enero 2026

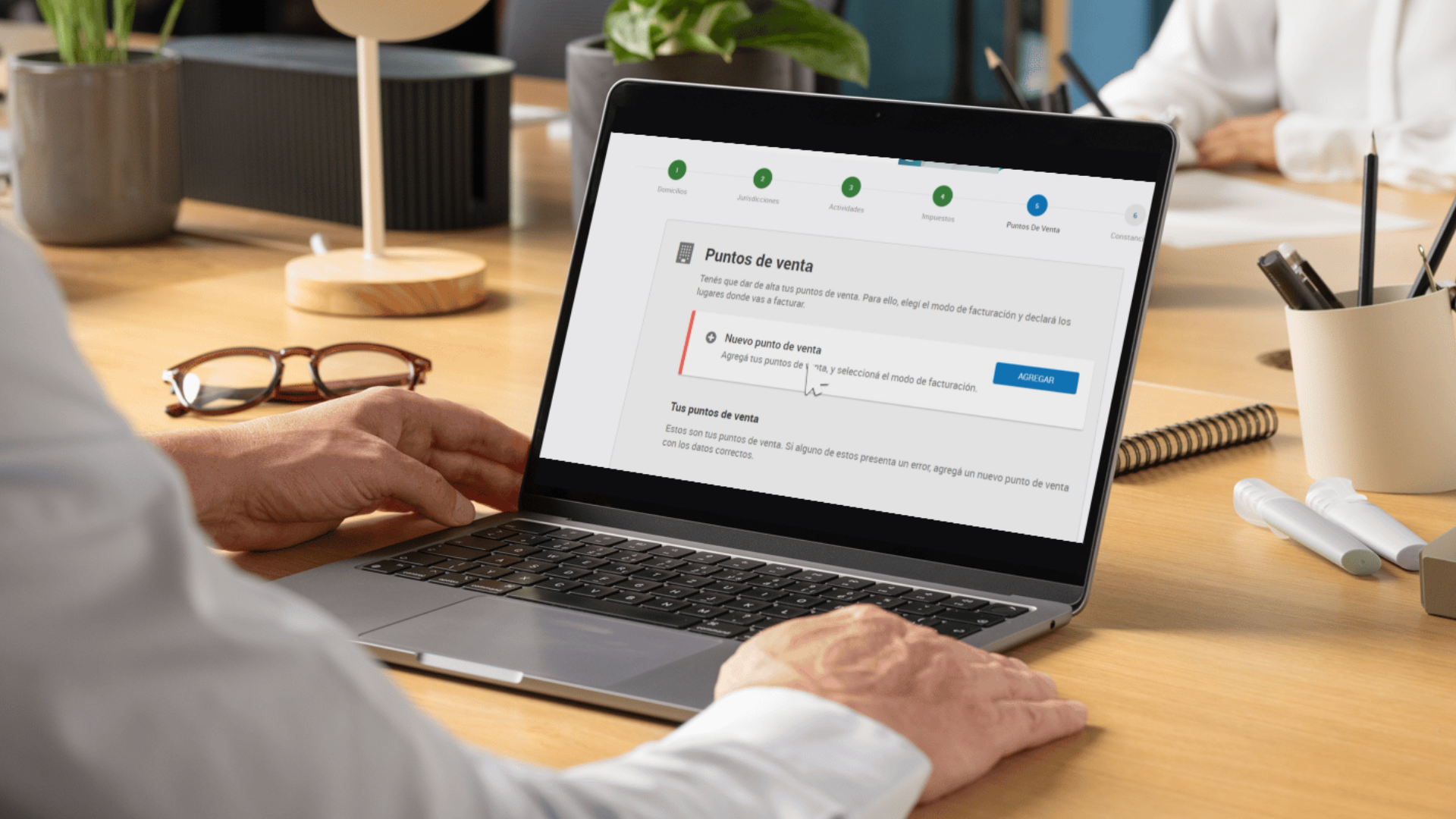

¿Cómo habilito puntos de venta?

THEY TRUST US

5CC 2009 – 2023 Algunos derechos reservados. Powered by Blissout Marketing Digital. When we share. Everyone wins.